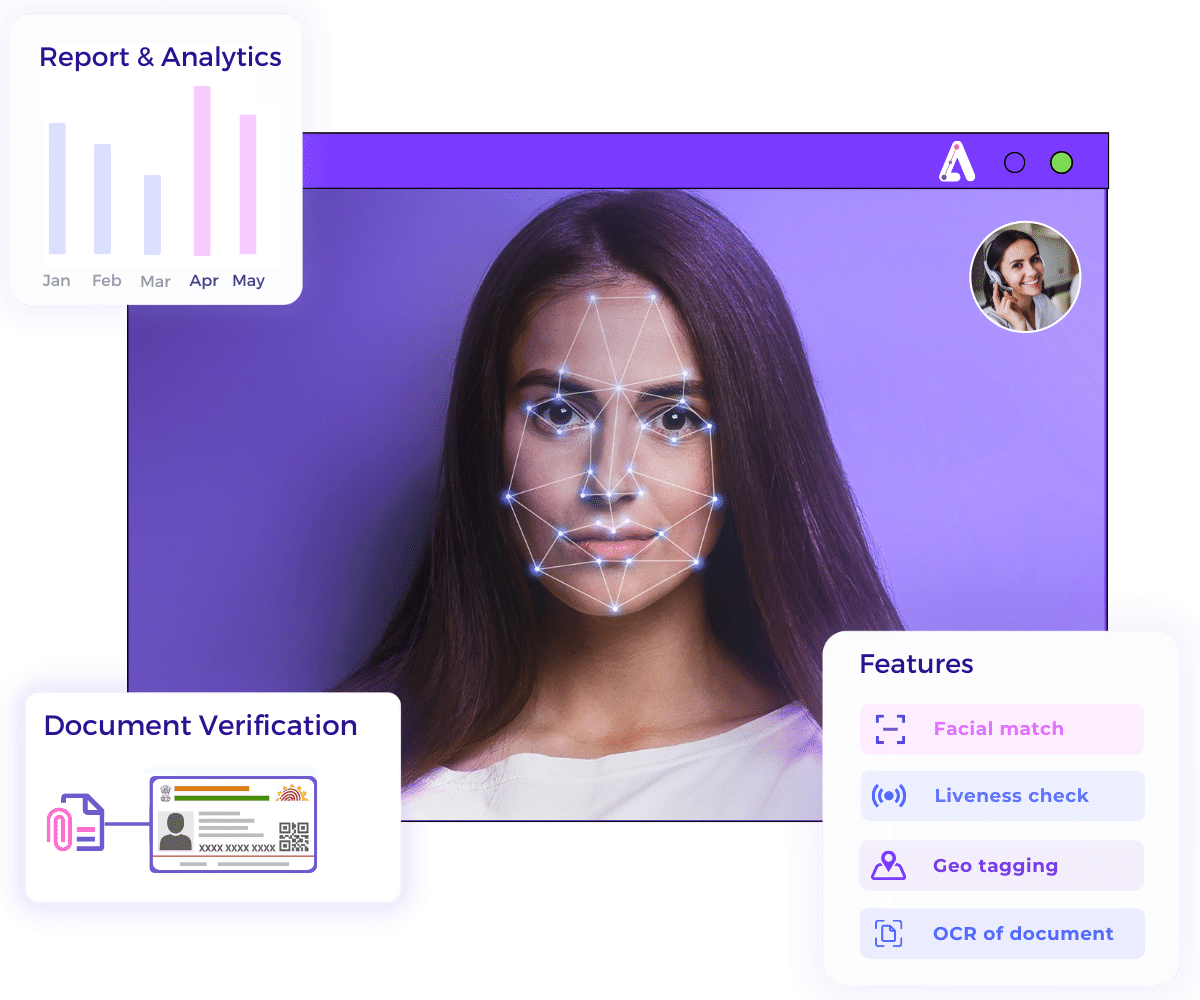

Video KYC

Our AI-based video-KYC platform instantly onboard customers, analyze documents and cross-check the identity of the users with artificial intelligence, advanced analytics, paperless processes and robust compliance systems to provide accurate results.

Our Client

Trusted by India’s leading financial institutions

Key Features ofAnurcloud Video KYC

Getting new customers and keeping your existing customer base happy & making sure they trust you can be challenging. To onboard a customer, you need to verify the proper ID documents and cross-check each customer’s details against various databases. Introducing AI-driven Anur e-KYC solution that helps enterprises speed up onboarding in real-time and automate document collection & verification with a 99.98% accuracy rate by offloading human resources.

Real time

Verify customers’ identities in real time by scanning their valid official documents using Optical Character Recognition (OCR) technology.

Increased reach

Now connect all customers with low bandwidth and multi-lingual supports, regardless of their connection speed and languages.

Simple to adopt

Get facial recognition, liveness check and video recording of customers.

Reduces risk

Built with advanced Multi factor authentication following the proposed privacy law and regulatory guidance

Easy reports and analytics

Simply access reports in the required format to get audit-ready analytics and dynamic reports.