How Anur Technologies is Reshaping the Insurance Industry with Pre-Issuance Video Verification Solution in India?

Anur Tech

March 15, 2024

As of 2022, India had a total of 67 insurance companies, out of which 26 operated in general insurance space and 24 operated in life insurance space. From the rest 5 insurance companies were in health insurance while the remaining 12 were re-insurance companies. The numbers are likely to grow with the increase in insurance penetration in India. As per estimates, India is all set to be the 6th largest insurance market globally by 2032.

While these stats and numbers seem promising, there are certain challenges faced by insurers. This includes spreading awareness of insurance products, particularly in verifying the authenticity of customer information and ensuring compliance with regulatory requirements. This calls for innovative solutions.

Anur Technologies, a pioneering company in the InsurTech sector, is transforming this process through its innovative Pre-Issuance Video Verification Solution. It not only increases efficiency but also improves customer experience in India.

In this article, we will cover what is Pre-Issuance Video Verification in India and how Anur Technologies helps insurance players with its PIVV solution.

What is Pre-Issuance Video Verification in India?

PIVV is a cloud-based solution that is built to create an integrated experience for policy buyers. It helps them to fully understand the policy details before purchasing the product while insulating the organization from potential mis-sellings.

PIVV helps with :

Ease of understanding

Creates an interactive presentation that can be viewed by the customer on their mobile devices.

Seamless process

Ensures that the sales process is seamless with a high level of integration.

Quicker policy issuance

Instant report generation with a rule engine to identify Straight-through Processing (STP) cases for faster issuance of policy.

In India, regulatory bodies like the Insurance Regulatory and Development Authority of India (IRDAI) have stringent guidelines in place under circular IRDAI/Life/Cir/Misc/274/11/2020 and IRDAI/Life/Cir/Misc/253/09/2021 to prevent fraud and ensure customer protection.

Insurance companies have to adhere to these regulations which also mention that the Pre-Issuance Verification Process has to be done online. There are also regulations such as the records of PIV having to be stored for three years and at least 3% of the sales should be verified to comply with the regulations.

All these requirements can be tedious for insurance companies with a large customer base and also require trained staff and resources.

To help here, Anur Technologies provides insurance companies with a Pre-Issuance Video Verification solution.

Why is Anur Technologies a Preferred Choice for Insurers for Pre-Issuance Verification Services?

Anur Technologies is a leading player in the InsurTech space with innovative offerings for insurers including Pre-Issuance Video Verification Solution. Our popular insurer clients are SBI Life Insurance, Manulife, Reliance Nippon Life Insurance, Canara HSBC Life Insurance, PNB MetLife.

We have developed the Pre-Issuance Video Verification (PIVV) solution, leveraging advanced technologies such as artificial intelligence (AI) and real-time rendering of visuals using gaming technology that ensures efficiency and builds a relationship of trust between clients and customers.

Here are some of the features & technology integration offered by Anur Technologies:

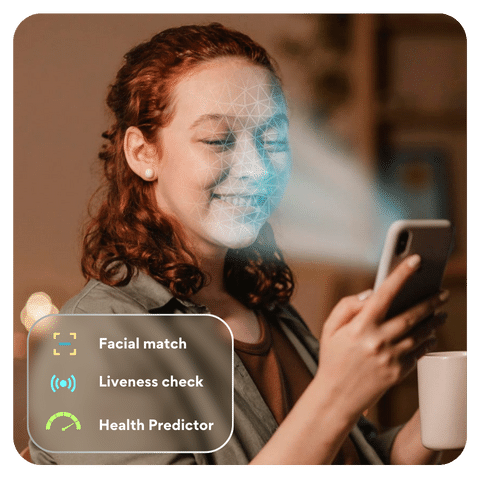

- Face recognition, Match, & Analysis

- Liveness check with video recording & user consent

- Geotagging in order to verify the location

- Multi-language support and guidance

- OTP & document-based verification

- Explains product details with voice, animation & graphs

- Speech-to-text technology for accurate transcription, facilitating streamlined voice consent processes at every step

- Health predictor for vital parameters like Blood Sugar, BMI, Heart rate, smoker, etc through facial analysis to reduce risk at Underwriting

We integrate the PIVV solution seamlessly into the insurer’s onboarding process, where it automatically initiates a pre-issuance video verification with the customer. During the process, the solution utilizes multiple security add-ons to authenticate the customer’s identity and validate the information provided in the application.

The process is completely online and is available in multiple languages to cater to different geographic regions.

Benefits of Choosing Anur Technologies for Pre-Issuance Video Verification

80% Reduction in TAT

Insurance companies can save up to 80% of their time for customer verification and onboarding. Anur Technologies PIVV solution offers real-time verification, which helps insurers with operational efficiency and faster policy issuance.

25% Cost Reduction

Traditional verification methods often involve manual processes which can cost additional resources. With Anur Technologies, insurers have experienced a 25% reduction in their overall cost of customer verification.

Increase in Customer Onboarding

Anur Technologies helps customers complete the verification process and understand products quickly via its Pre-Issuance Video Verification solution. We have seen that our process has helped our clients with a 10x quicker application process.

Reduction in Fraud

Fraudulent claims are a major concern for insurers, which can also lead to regulatory challenges. Our PIVV solution uses technologies like AI and ML to detect inconsistencies or discrepancies in customer information.

Conclusion

Pre-Issuance Verification Process is a regulatory requirement in India and Anur Technologies with its advanced tools is revolutionizing this process for insurers in India. We offer insurance companies a seamless, efficient, and secure Pre-Issuance Verification Process solution. Customers can easily follow voice instructions and complete the entire verification process in a few minutes.

To know more, book a demo call with us today.